Thanks to a jump in bank failures and a continued worsening trend in the credit union sector, quarterly mortgage-related casualties rose to the highest level in a year. The forecast is for a decline in bank failures and an increase in credit union and non-bank closings.

There were 35 mortgage-related casualties in the first-half 2013, according to The Mortgage Graveyard from Mortgage Daily.

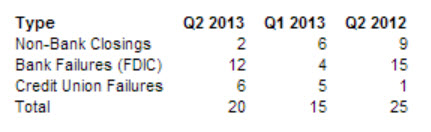

The second-quarter portion of the total was 20, more than the 15 tracked in the first quarter and the worst quarter of the past four.

However, the industry lost fewer businesses than the 25 reported for the second-quarter 2012 .

Non-bank closings accounted for just two of the latest quarter’s casualties, down four from the first quarter.

But bank failures jumped to 12 from four in the prior period.

Credit union casualties rose for the fourth consecutive quarter to six.

With 30-year fixed mortgage rates hovering more than a hundred basis points above the all-time low of 3.31% reached in the week ended Nov. 21, 2012 , and potentially climbing higher — some non-bank lenders that have relied primarily on refinances could be forced out of business.

If credit union casualties — which have risen each quarter since the second-quarter 2012, when there was just one — continue on their current trajectory, even more can be expected this quarter.

But although bank failures surged in the latest quarter, the pace has recently slowed, with the last bank failure — Mountain National Bank in Sevierville, Tenn. — having occurred a month-and-a-half ago. The recent slowing suggests fewer bank failures in the third quarter.

RealEstateEconomyWatch.com Insight and Intelligence on Residential Real Estate

RealEstateEconomyWatch.com Insight and Intelligence on Residential Real Estate

One comment

Pingback: Banks On The Verge of Collapse: Up To 46% Of Bailed Out Homeowners Can’t Pay Their Mortgage (Again), Monthly Home Payment Soars 40% To 2008 Levels, And Bernanke Is Definitely Going To Taper Soon! | Alternative News Alert!