Nearly two out of three applications for mortgages to buy a home were approved in August, a new high for purchase loan approvals. Despite the progress tight lending standards are still handicapping the housing recovery.

The closing rate is a new high for Ellie Mae’s monthly Origination Insights reports, which began in late 2011. Since November 2011, the purchase loan average closing rate has risen 9.9 percent. However refi closing rates have risen further, making the combine closing rate increase for both loan types 14 percent according to Ellie Mae, the mortgage software program that process about 3.5 million mortgages a year.

In August the closing rate for purchase loans was 65.1 percent, or about two out of every three applications. The good news is that two years ago the rate was 61.0%. Two years and four percentage points.

More sobering is the fact that only 27 percent of those who got mortgages to buy houses were first-time buyers. First-timers, vital players in the housing economy, are dangerously few. Younger, with lower incomes and less established credit, many saddled with student debt, first-timers have lost 25 percent or more market share in home sales, largely because of their difficulty getting credit.

Realtors report that despite the slow progress, access to credit is continuing to constrain the housing recovery. About 18 percent reported having clients who could not obtain financing in August 2014, according to the National Association of Realtors.

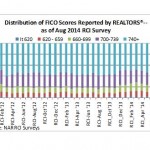

That the vast majority of mortgage applicants applications today are not the “no doc” and “pulse loan” (if you have pulse you get a loan) borrowers who existed ten years ago. Rather, a large number are pre-qualified or pre-approved by lenders who know what they are up against. They have worked hard to get their credit, debt and paperwork in order. About 50 percent of survey respondents who provided credit score information to NAR’s monthly Realtor Confidence Index survey reported FICO credit scores of 740 and above. Only about 2 percent of REALTORS reported a purchase by a buyer with a credit score of less than 620. In 1999.

RealEstateEconomyWatch.com Insight and Intelligence on Residential Real Estate

RealEstateEconomyWatch.com Insight and Intelligence on Residential Real Estate

3 comments

Pingback: Closing Rates for Purchase Loans Hit New High….Finally | Belair Realty

Pingback: Just Knock

Pingback: Closing Rates for Purchase Loans Hit New High | Hampton Roads Realty News